what triggers net investment income tax

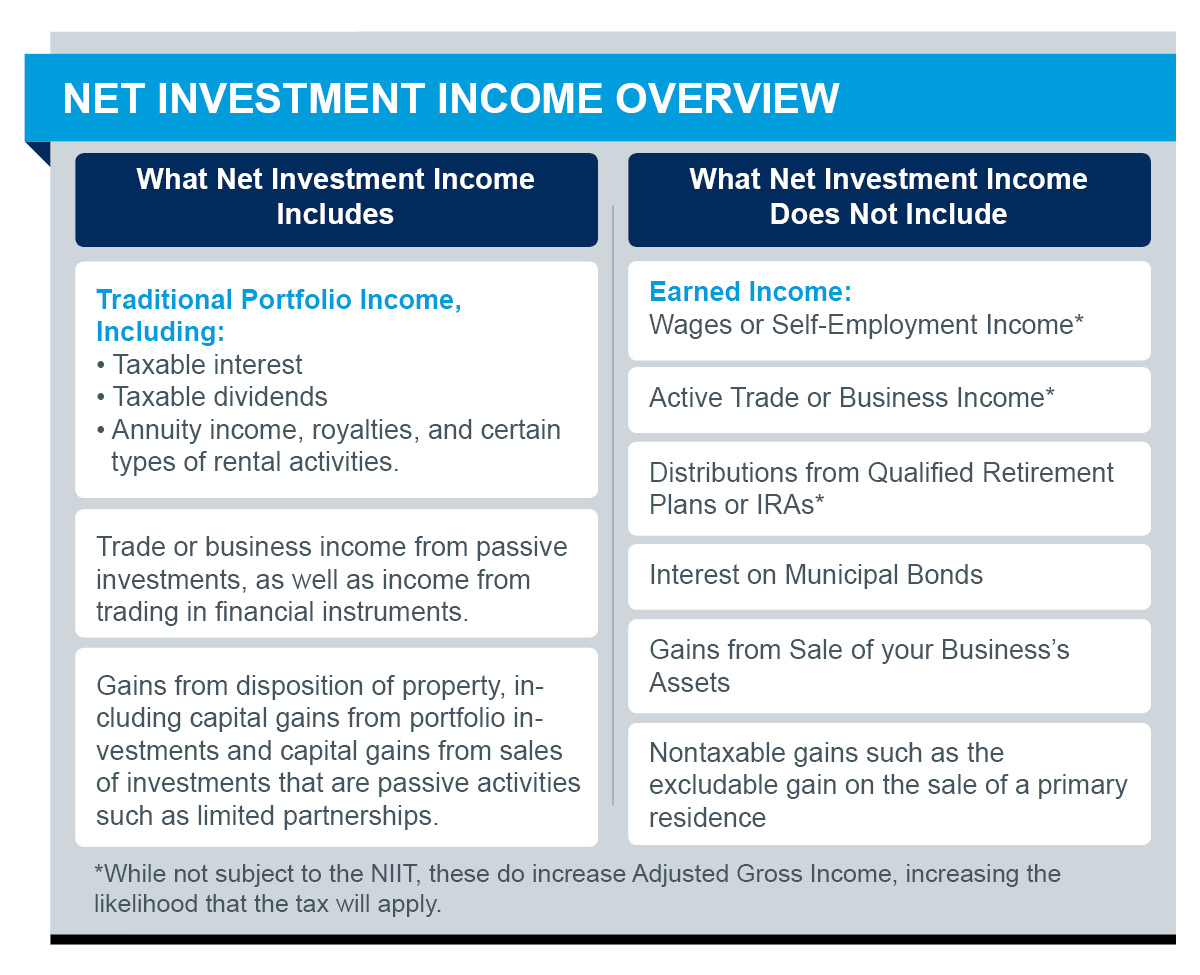

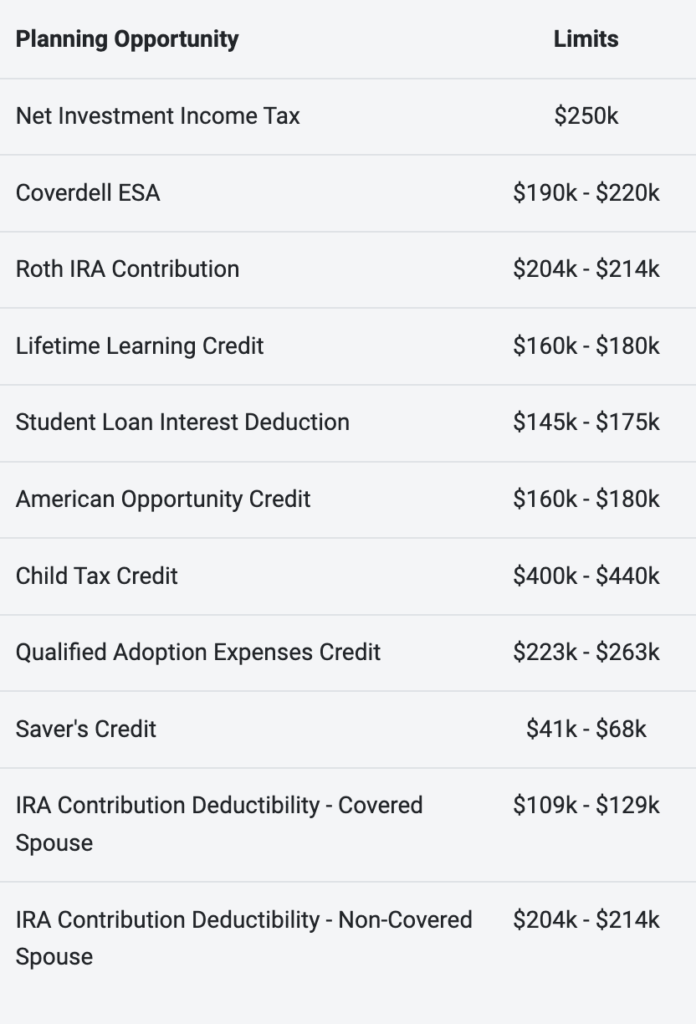

If we can increase investment expenses to lower our net income that is another way to avoid the Net Investment. Your net investment income is less than your MAGI overage.

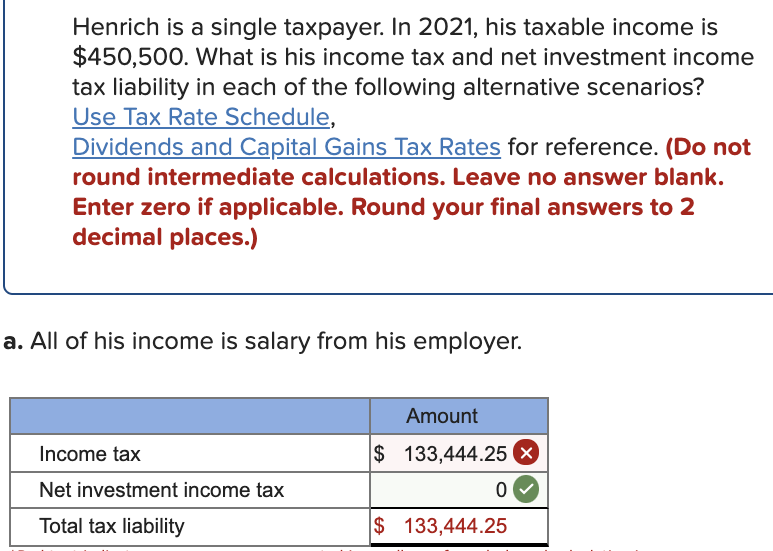

What Is Net Investment Income Tax Overview Of The 3 8 Tax

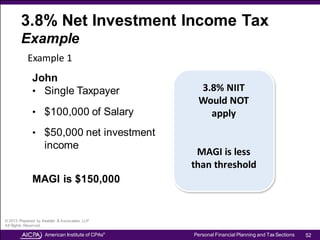

Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

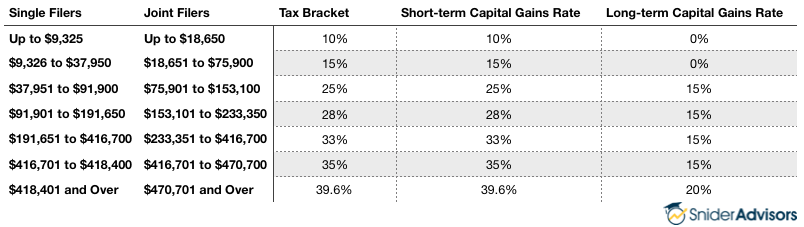

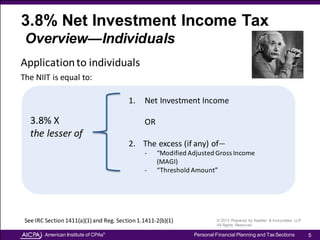

. In this case the taxpayer pays the 38 tax on the lesser of 50000 which is the amount by which the modified gross income exceeds the 250000 threshold or 100000. 1411 is a 38 tax on the lesser of 1 net investment income or 2 the excess of modified adjusted gross income MAGI over. Web The net investment income tax targeted primarily toward the wealthy is an additional tax on top of regular tax liability.

Its net investment income and not gross investment income. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted.

Net investment income tax This additional 38 tax generally affects upper-income investors either single taxpayers with modified adjusted gross incomes over 200000 or. Net Investment Income Tax. 1 It applies to individuals families estates and trusts.

Their MAGI exceeds the threshold of 250000 for a married couple filing jointly by 10000 230000 30000 250000 10000 and their net investment income is 30000. Web In this case the taxpayer pays the 38 tax on the. Youll owe the 38 tax.

Although it has been. The net income investment tax NIIT is a 38 tax applied to rental property income and capital gains once certain income thresholds are met depending on your filing.

9 Common Questions About Investment Income Tax

Understanding The Net Investment Income Tax Calculation And Examples Thinkadvisor

Form 8960 Net Investment Income Tax Individuals Estates An Trusts 8960 Pdf Fpdf

2014 11 21 Net Investment Income Tax Probity Advisors Inc

Secure Act S Increase In Rmd To Age 72 May Lead To Avoidance Of Net Investment Income Tax Hall Benefits Law

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Understanding The Net Investment Income Tax

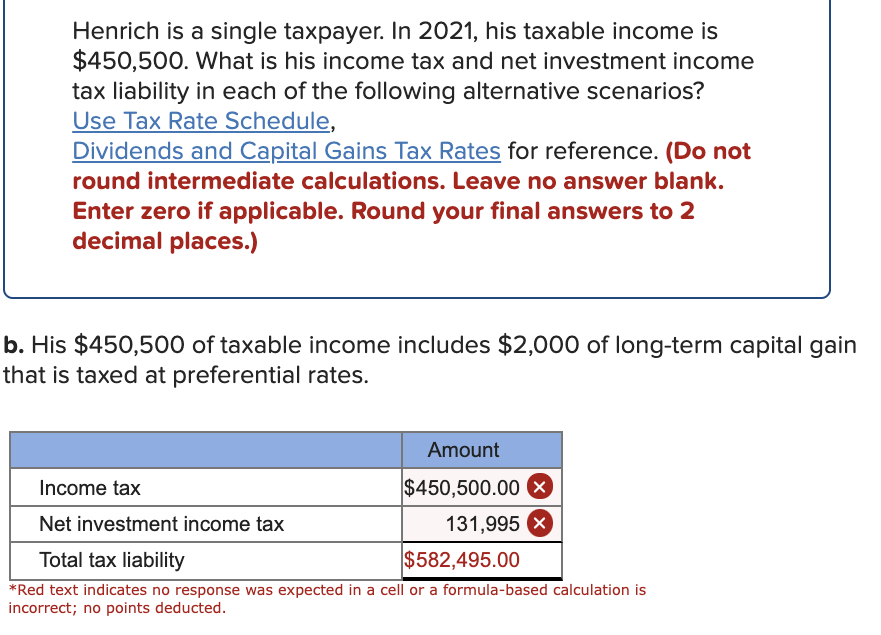

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

Net Investment Income Tax And How To Avoid It Go Curry Cracker

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

Calculation Error On Additional Net Investment Inc

How Is The Net Investment Income Tax Niit Calculated

Understanding The Net Investment Income Tax

7 Smart Ways High Earners Can Prep For A Smoother Tax Season Wingate Wealth Advisors

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Income Is 450 000 What Is His Income Tax And Net Investment Income Tax Liability In Each Cliffsnotes

How To Calculate The Net Investment Income Properly

Is The Net Investment Income Tax Still In Effect Drilldown Solution Act

New Brackets Net Investment Income Tax Expand Scope Of Tax Planning